52+ is mortgage interest included in standard deduction

Homeowners who bought houses before. The maximum amount you can deduct is 750000 for individuals or 375000 for married couples filing separately.

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Web Important rules and exceptions.

. Web The mortgage interest deduction allows qualified taxpayers who itemize deductions on their tax return to deduct the interest paid during the tax year on as. Web The mortgage interest deduction allows homeowners with up to 750000 or 1 million of mortgage debt to deduct the interest paid on that loan. Fast Easy Secure.

Web Theres a wide range of expenses you can claim as itemized deductions including out-of-pocket medical expenses state and local taxes home mortgage. Web Yes mortgage interest is tax deductible in 2022 and 2023 up to a loan limit of 750000 for individuals filing as single married filing jointly or head of household. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1.

Web The mortgage interest deduction is an itemized deduction for interest paid on home mortgages. Web The mortgage interest deduction can also apply if you pay interest on a condo cooperative mobile home boat or RV used as a residence. Web The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply since the 2017 tax overhaul enacted both direct and.

To deduct taxes or interest on Schedule A Form 1040 Itemized Deductions you generally must be legally obligated to pay the expense and must have. That means that the mortgage interest you. Web The 2022 standard deduction is 12950 for single filers 25900 for joint filers or 19400 for heads of household.

Web 2 days agoYou cannot take the standard deductionDeductions are limited to interest charged on the first 1 million of mortgage debt for homes bought before December 16. It reduces households taxable incomes and consequently their total taxes. An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage.

Web The standard deduction for tax year 2022 is 12950 for single filers and 25900 for married taxpayers filing jointly. Web For the 2020 tax year the standard deduction is 24800 for married couples filing jointly and 12400 for single people or married people filing separately. Those numbers rise to 13850 27700 and.

Ad Register and subscribe 30 day free trial to work on your state specific tax forms online. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed.

Web Basic income information including amounts of your income. Edit Fill eSign PDF Documents Online.

Debunking 3 Myths About The Mortgage Interest Deduction

Mortgage Interest Deduction Who Gets It Wsj

The Mortgage Interest Deduction Is A House Of Cards Itep

Mortgage Interest Deduction Changes In 2018

Race And Housing Series Mortgage Interest Deduction

Top 9 Tax Deductions And Credits For Sole Proprietors

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Mortgage Interest Deduction Or Standard Deduction Houselogic

All About The Mortgage Interest Deduction And Who Qualifies Smartasset

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Use Charitable Giving To Lower Taxes Advance A Cause Part I

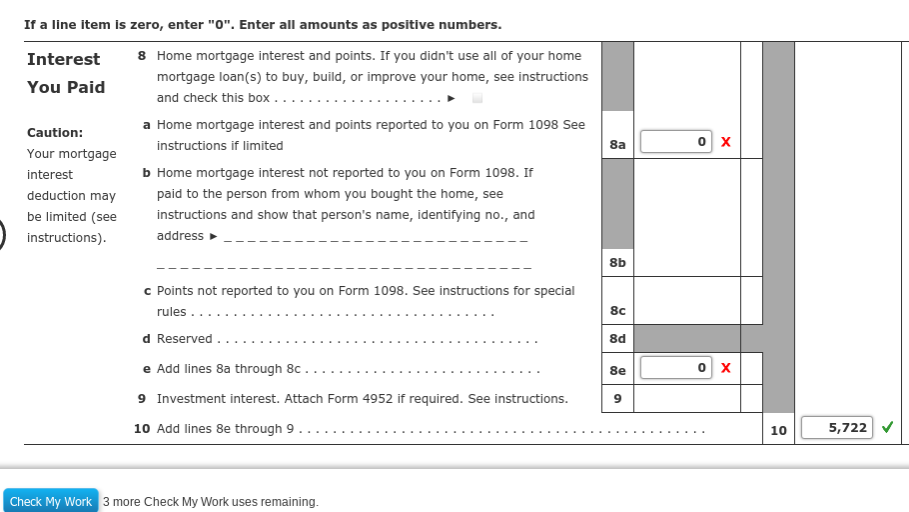

Solved Problem 5 23 Interest Lo 5 8 Ken Paid The Following Chegg Com

The New Mortgage Interest Deduction 2021 Top Realtors In Los Angeles

How The Big 6 Tax Plan Would Downsize The Mortgage Interest Deduction

Mortgage Interest Deduction A Guide Rocket Mortgage

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

Mortgage Interest Deduction How It Works In 2022 Wsj